Find the Best Mortgage Rates in Canada

Today’s Mortgage Rates updated as of 05/11/2024 9:56 AM

For a property located in

5-year fixed*

5-year variable*

(Prime -1.15%)

*Insured loans. Other conditions apply. Rate in effect as of today.

The Best Mortgage Brokers in Canada

Featured On

How Can Citadel Mortgages Help You Today?

Discover the average savings of current Citadel Mortgage clients when they choose Citadel Mortgages over the top banks!

While 33% of non-homeowners believe they'll never own*, our Citadel mortgage brokers are 100% confident they can make it happen. How? With our expert advice and guidance.

$300,000

Mortgage Loan

$12,414

(5-years interest savings with Citadel Mortgages)**

$232/month

(Interest savings with Citadel Mortgages)

$500,000

Mortgage Loan

$17,090

(5-years interest savings with Citadel Mortgages)**

$290/month

(Interest savings with Citadel Mortgages)

SOME OF THE BEST MORTGAGE RATES CANADA

Our Featured Rates

What Mortgage Rate Is Best For Me?

The Citadel Mortgage Difference

When it comes to speed, transparent advice, and low mortgage rates, we excel. Discover how we compare to big banks and brokers in Canada.

Utilize our mortgage calculators to determine the home affordability that suits you best!

Calculate how much you’d spend each month to buy a home or renew or refinance your mortgage.

Discover how much cash back you could receive with our Cash Back Mortgage Calculator.

Transparency - What You Need To Know About Your Mortgage Journey

Often during your mortgage journey, you will run into bank specialists and other mortgage agents or brokers that will tell you what you want to hear, so you give them the documents required to get your approval. While we understand you as a client want to hear you will get the lowest rate, please be aware that unless any mortgage broker or bank specialist has been given all the required documents and has fully underwritten your file, any rates offered are just quotes and not firm approval. Many times we find clients have been told what they want to hear because either the client has forced the mortgage broker or bank specialist to say to them the lowest rate, or they have just been told that to try and make the deal more effortless, but only to get to closing day to have the lender pull out of the deal!

Imagine you are at the lawyers to find out your deal was not approved because of something they found in your file; this happens often. This is why we ask for all the required documents upfront at Citadel Mortgages to ensure things like this do not happen at closing. We understand not all clients want to follow our award-winning process, which is OK with us; it just means we can not work together.

Have you ever wondered why you have to provide more documents to a mortgage broker in Canada than to your own bank? It’s a common question asked by clients who are beginning their mortgage journey, and we have an answer for you.

Mortgage brokers are intermediaries who work with multiple lenders to find you the best deal for your mortgage. Unlike your bank, which has access to your financial information, mortgage brokers don’t have access to your financial history or any other information that might help them determine your creditworthiness.

Therefore, to obtain a mortgage from a lender, brokers need to gather as much information as possible about your financial situation. This includes details about your income, employment history, credit history, savings, assets, and debts. Gathering this information helps brokers to understand your financial capacity and identify the best lenders and products for you.

Moreover, lenders also require a thorough verification process to ensure the accuracy of the information provided by clients. In addition, they are required to follow strict regulatory guidelines to prevent money laundering and fraudulent activities. Therefore, brokers must obtain all required documents to present a complete and accurate application to the lenders.

In contrast, your bank has access to your financial information, and therefore, you don’t have to provide as much documentation. However, you might not always get the best deal from your bank since they are only offering their own products. Working with a mortgage broker gives you access to multiple lenders and products, increasing your chances of finding the best deal for your unique situation.

At Citadel Mortgages, we understand that providing so many documents can be overwhelming. However, we work hard to make the process as seamless as possible for you. Our award-winning process ensures that we collect all the required documents upfront, reducing the risk of any delays or issues during the mortgage process.

If you’re ready to start your mortgage journey, contact us today, and our team of experts will guide you through the process and help you find the best mortgage deal for you.

As an award-winning national brokerage across Canada, we have been featured in the National Post, Financial Post, Toronto Sun, Ottawa Citizen, CMP Mortgage and many more. So, what type of experience do you wish to have? One where you hear what you want only to have issues maybe later or the latter where we are honest and only provide you with the correct information once your apporved?

We ask you to trust our award-winning process and allow us to collect all the documents so we can help you in your mortgage journey!

Don’t believe us read our client reviews and read our national articles as we offer the best service and mortgage rates for your mortgage journey!

Citadel Mortgage Programs

EXCLUSIVE CITADEL WORLD ELITE REWARDS CARD

Welcome to the family, a gift from our family to yours. The Citadel World Elite Rewards Card is an exclusive member-only rewards program unlike anything ever seen in the mortgage industry.

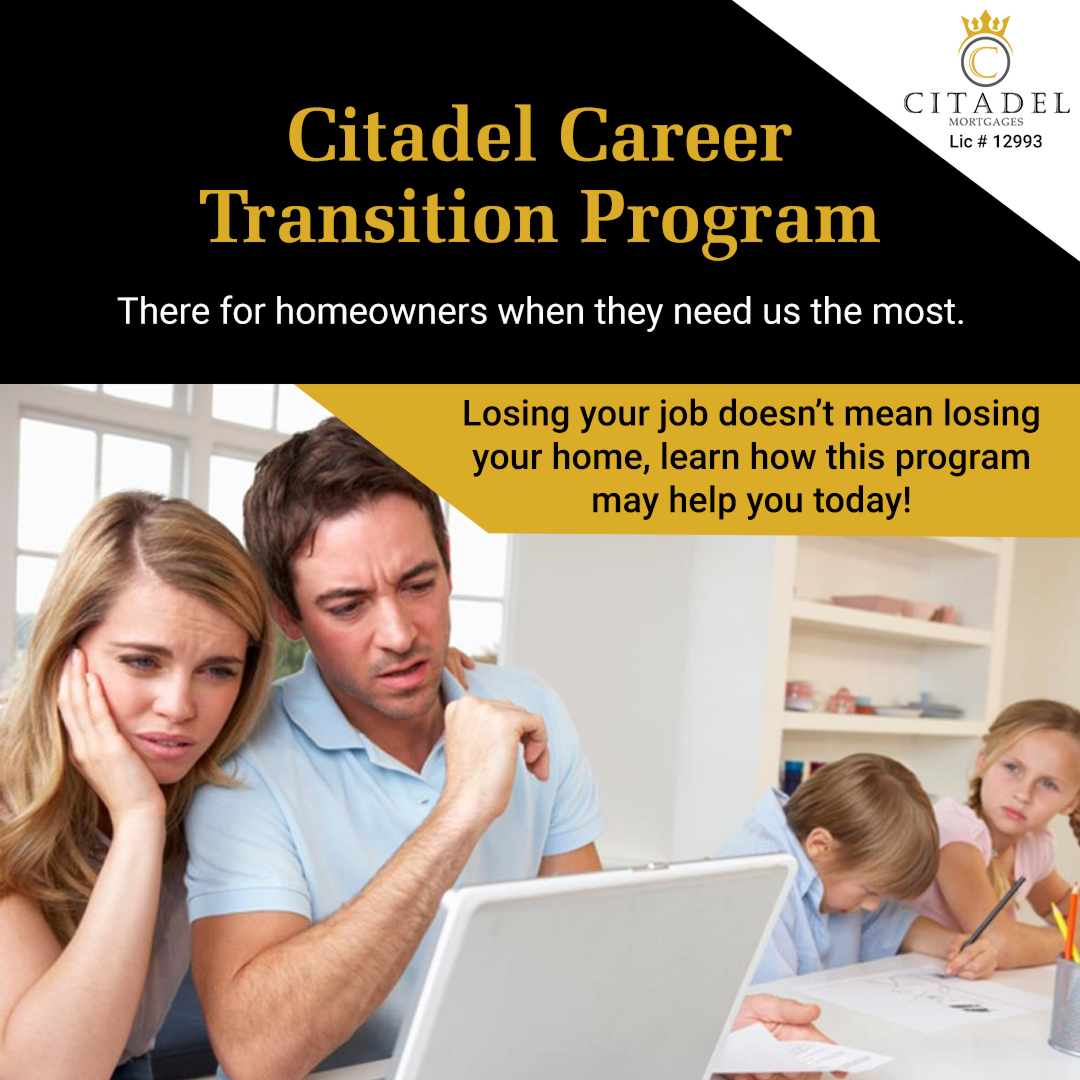

CAREER TRANSITION PROGRAM

HELPING BORROWERS GET BACK ON TRACK Sometimes job loss can happen without warning. The Citadel Mortgages Career Transition Program is here to support you through this difficult time.

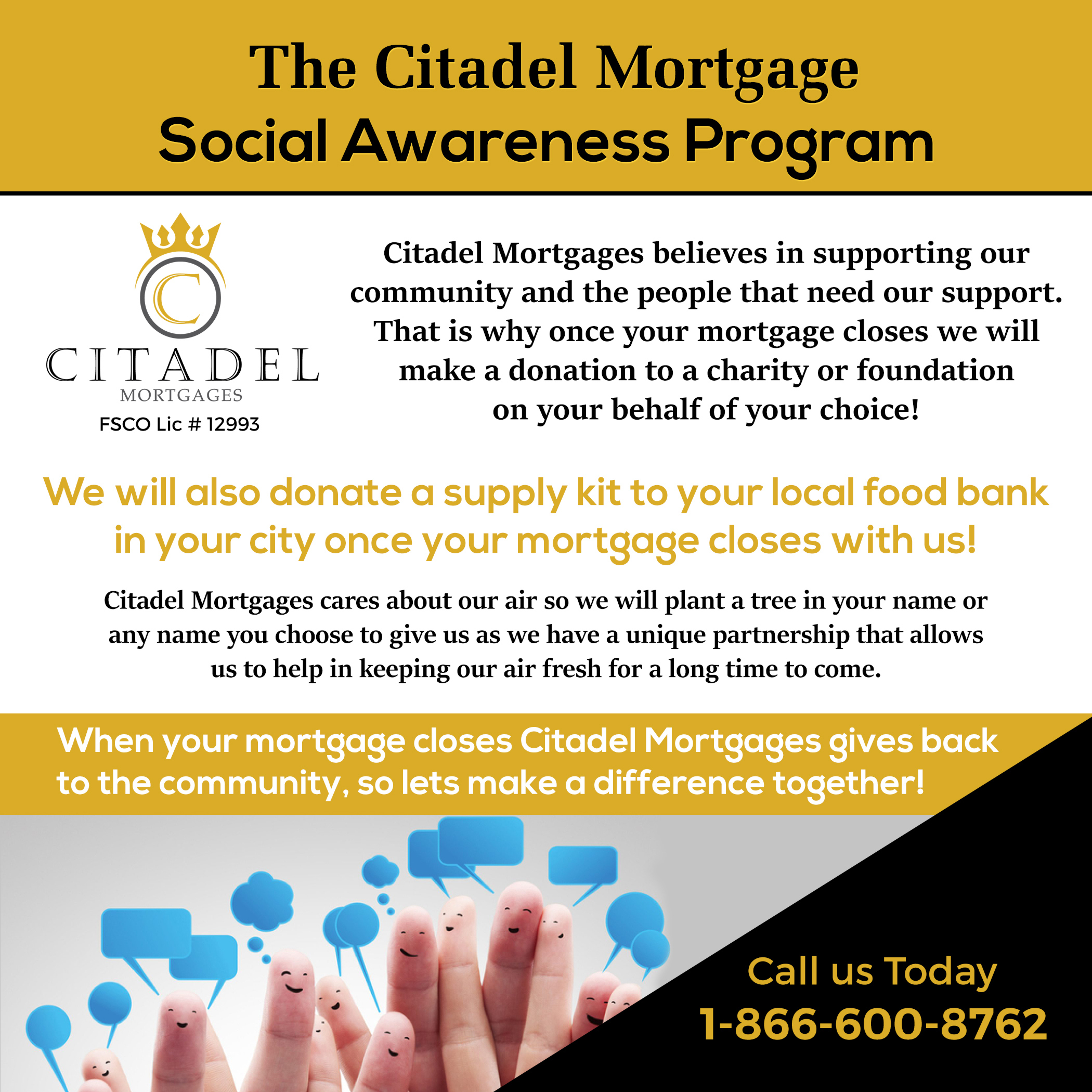

The Citadel Mortgage Social Awareness Program

Citadel Mortgages believes in supporting our community and the people that need our support. That is why once your mortgage closes, we will make a donation to a charity or foundation on your behalf of your choice and plant a tree that you name!

OUR TRUSTED LENDER PARTNERS

Home and Auto Insurance

When was the last time you got a second opinion on your home insurance? Apply now for a no-obligation quote and save today!

High Interest Banking Accounts

Unlock a high-interest account tailored to your everyday banking needs. Experience great features, unparalleled flexibility, and exceptional rates on all your money!

Better Mortgage Insurance That Makes Sense

Experience comprehensive protection with our Mortgage Insurance, offering full coverage including term life, critical illness, and disability coverage.

Our Awards

Client Success Stories

Our clients always come first. Our goal is to help you get the best advice and mortgage solutions for your needs. Citadel Mortgages was formed to help you achieve your financial home success so allow us to help you today. Speak to one of our mortgage agents today!